Why Bonds Are Increasingly Attractive for Long-Term Investors

The bond market has had a better year in 2023 despite ongoing swings in interest rates. The U.S. Aggregate bond index has rebounded 2.7% year-to-date after briefly hovering in the red a few months ago. This is because inflation continues to improve, and many investors believe the Fed is not only done raising rates but may begin cutting next year. This is also in stark contrast to 2022, when the US aggregate bond market had its worst year in history and fell 13% as interest rates rose swiftly. So, while the bond market is having a better but not exceptional year, the economic climate may be shifting in its favor. What should diversified investors consider as the interest rate story continues to unfold?

Bonds are highly sensitive to interest rate fluctuations

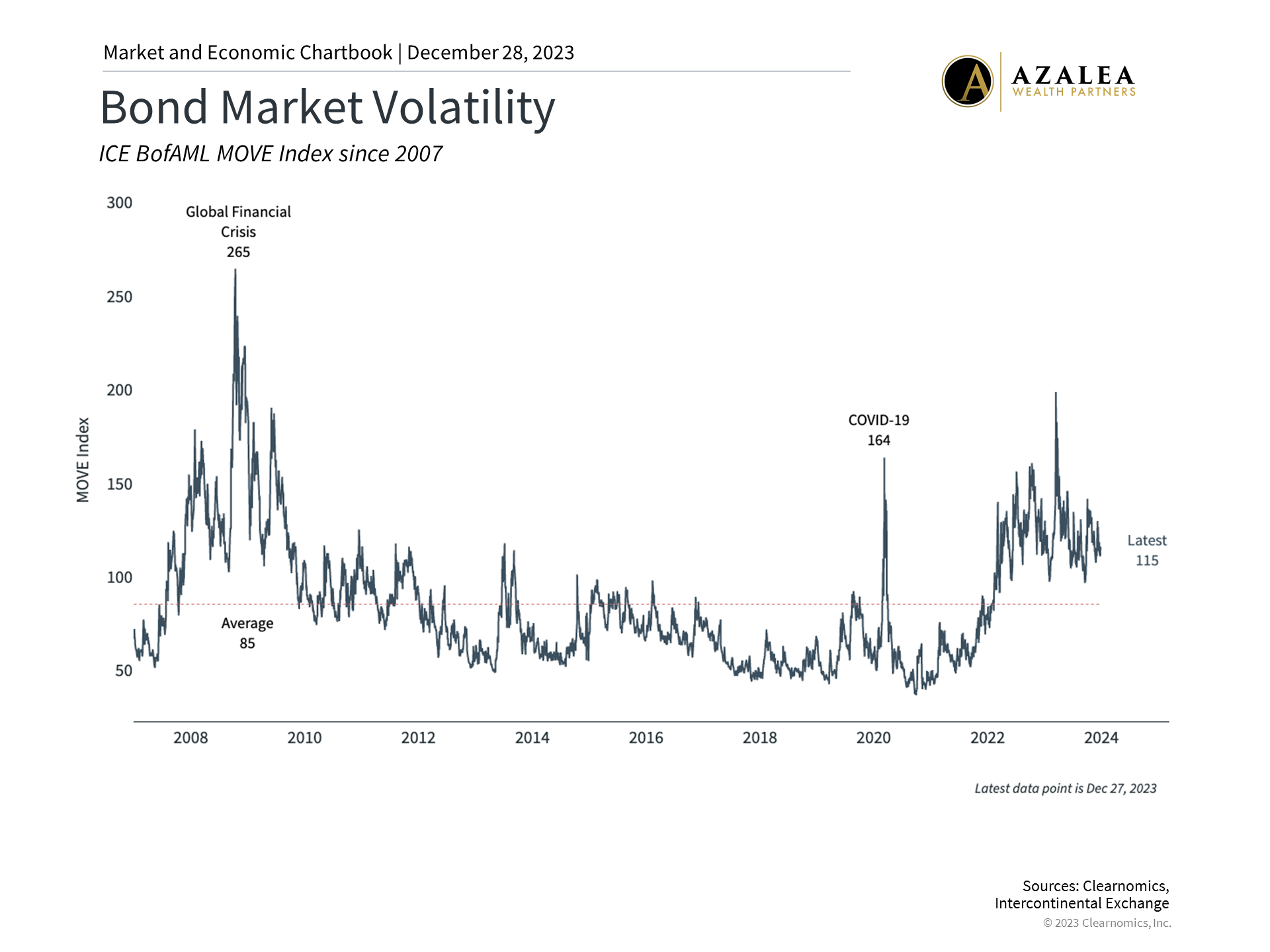

Bond market volatility has remained elevated this year due to the banking crisis and the rate jump that began in late summer. The 10-Year Treasury yield has risen from 3.9% at the start of the year to 4.2% today, briefly hitting 5% along the way. For perspective, the 10-Year yield was only 1.5% at the beginning of 2022 and fell as low as 0.5% in 2020. Both the level and change in rates impact the prices and returns of the bond market, affecting portfolio returns.

These dynamics have called into question the traditional role of bonds as portfolio stabilizers and consistent sources of yield and returns. Ideally, bonds rise when stocks fall, leading to more balanced portfolios. This was generally the case from the mid-1980s until recently as steadily declining interest rates led to higher bond prices over those 40 years. While the past few years have led some investors to question whether this pattern will resume, it's important to examine why bonds behave this way in the first place.

One way to understand why bond prices tend to fall when interest rates rise is that investors can now buy bonds with higher yields, reducing the value of previously issued bonds. The reverse is also true: when interest rates fall, bond prices tend to rise. Rising rates mean that the present values of future bond payments are worth less than they were when they were first issued. This is true when interest rates rise for any reason but can be especially challenging when this is due to inflation.

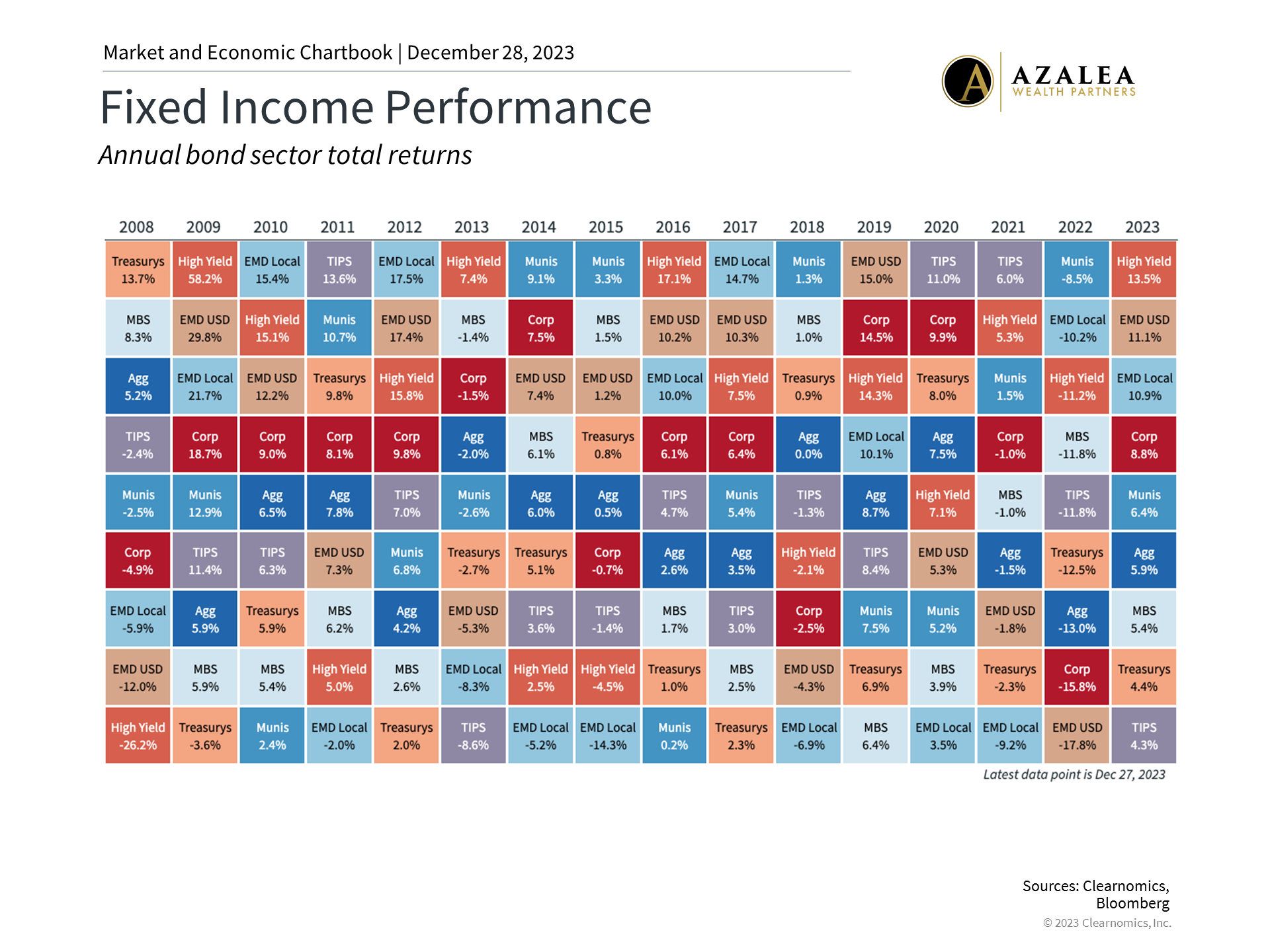

Many bond sectors have rebounded in 2023

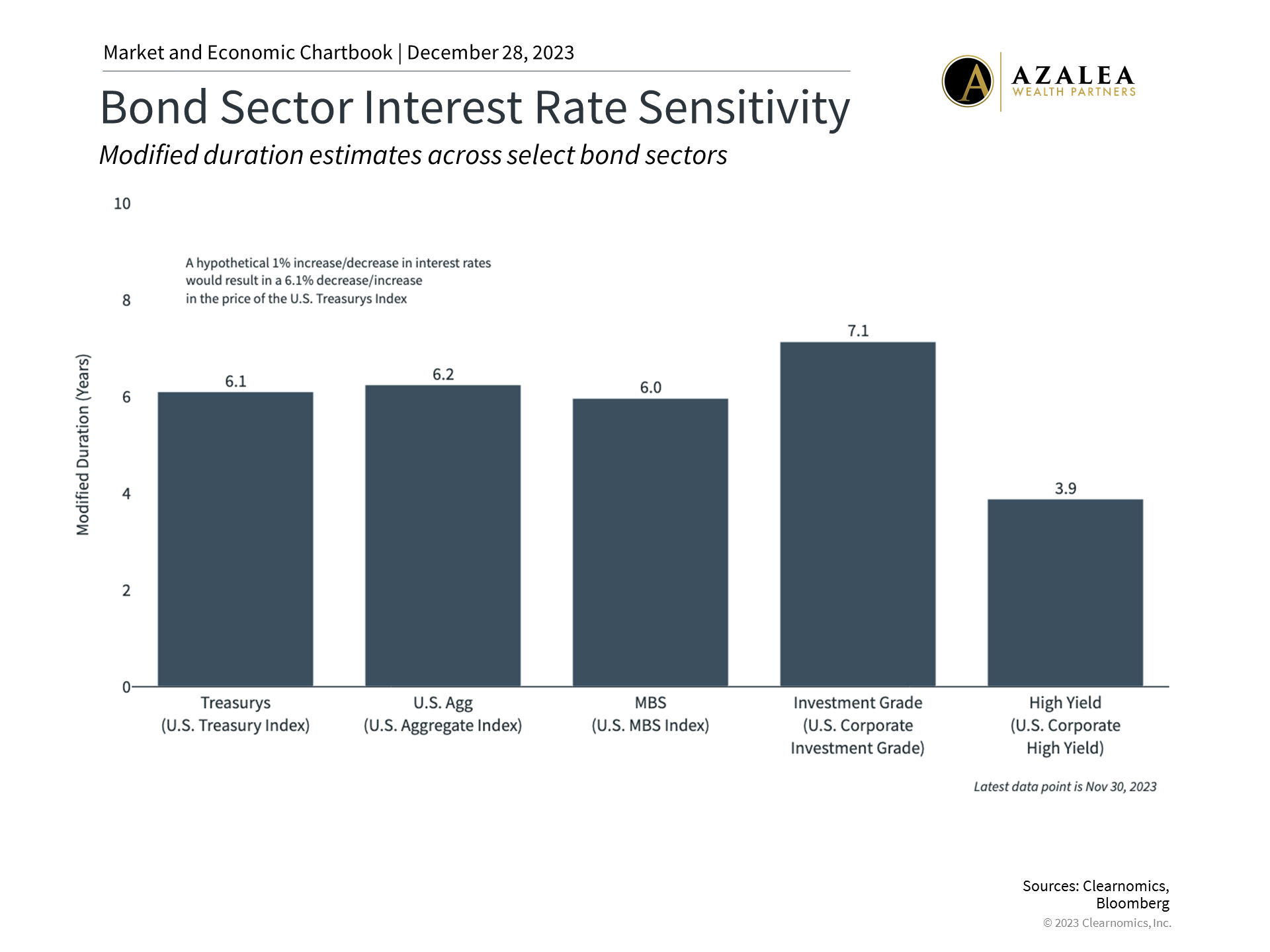

To measure the effect that changing interest rates have on bond prices, investors often use a concept known as "duration" (in this discussion we'll focus on "modified duration"). In its simplest form, duration tells us how much the price of a bond (or bond index) would gain or lose if interest rates were to fall or rise by one percentage point. For example, the accompanying chart shows that the U.S. Treasury Index has a duration of 6.1 years, implying that a 1% rise in interest rates would result in a 6.1% decrease in the price of the bond index, and vice versa.

Duration varies across bond sectors depending on their characteristics. High yield bonds, for instance, tend to be highly correlated with stocks and have shorter maturities so are less sensitive to interest rates alone. They are among the best performing parts of the market this year as risky assets have surged. High quality corporate bonds, on the other hand, tend to be more sensitive to interest rates since investors buy them for their coupon payments. These bonds have gained 5.2% this year on average as interest rates have stabilized and the economy has grown steadily.

Bond market volatility has been elevated

So, while the jump in interest rates over the past two years has raised questions for some asset allocation strategies, the bond market reaction is understandable. These concepts suggest that more stable rates would be a welcome sign for investors and could help to reestablish bonds as portfolio stabilizers. Since duration calculations go in both directions, bond prices could benefit if rates were then to decline. The possibility that the Fed could cut rates next year has already supported bond prices and could continue to do so if long-term interest rates begin to ease as well.

The bottom line? While bonds have struggled as interest rates have risen, calling into question the traditional 60/40 portfolio, there are signs that rates could stabilize in the year ahead. This could bode well for bond markets going forward, but investors should be cautious before assuming bonds will necessarily return to the stabilizing role they played between the 1980s and 2020.

Copyright (c) 2023 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Municipal bonds are subject to availability and change in price. They are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply. If sold prior to maturity, capital gains tax could apply.